Profit and Loss Appropriation account is the part of financial statements of company.

It is different from profit and loss appropriation account of partnership firm.

When a company makes his profit and loss account, its net profit is transferred to the credit side of profit and loss appropriation account.

Profit and loss account shows only the net profit or net loss from operation of business but profit and loss appropriation accounts shows all non- operational adjustment which is needed for proper distribution of net profit between shareholders and company for future growth.

So, net profit of P/L A/c is used for providing reserve, dividend, dividend distribution tax and adjustment of income tax.

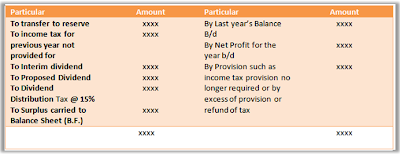

In the debit side of this account, we will show the following items.

1. Transfer to reserve /general reserve.

2. Transfer to dividend/interim dividend/proposed dividend.

3. Debenture redemption fund account.

4. Dividend equalization fund account.

5. Dividend Distribution Tax (A 15% dividend distribution tax and surcharge of 3% is paid by companies before distribution.)

6. Income tax for previous year not provided for.

7. Surplus transfer to balance sheet.

In the credit side of this account, we will show the following accounts

1. Balance of surplus of previous year.

2. Net Profit of this year.

3. Amount withdrawn from general reserve or any other reserve.

4. Provision such as income tax provision no longer required or excess of provision or refund of tax.

When a company makes his profit and loss account, its net profit is transferred to the credit side of profit and loss appropriation account.

Profit and loss account shows only the net profit or net loss from operation of business but profit and loss appropriation accounts shows all non- operational adjustment which is needed for proper distribution of net profit between shareholders and company for future growth.

So, net profit of P/L A/c is used for providing reserve, dividend, dividend distribution tax and adjustment of income tax.

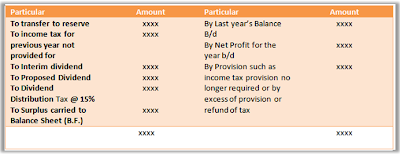

In the debit side of this account, we will show the following items.

1. Transfer to reserve /general reserve.

2. Transfer to dividend/interim dividend/proposed dividend.

3. Debenture redemption fund account.

4. Dividend equalization fund account.

5. Dividend Distribution Tax (A 15% dividend distribution tax and surcharge of 3% is paid by companies before distribution.)

6. Income tax for previous year not provided for.

7. Surplus transfer to balance sheet.

In the credit side of this account, we will show the following accounts

1. Balance of surplus of previous year.

2. Net Profit of this year.

3. Amount withdrawn from general reserve or any other reserve.

4. Provision such as income tax provision no longer required or excess of provision or refund of tax.

No comments:

Post a Comment